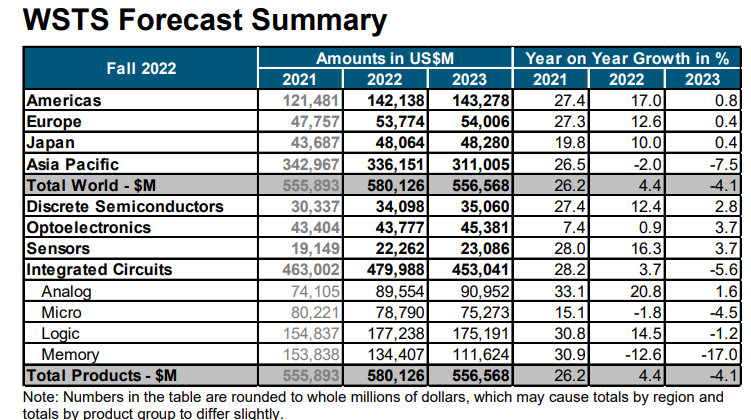

The global semiconductor market is expected to shrink by 4.1 percent to $557 billion in 2023 due to the sharp freeze in the memory chip market, according to the latest forecast released by the World Semiconductor Trade Statistics Association (WSTS). It is the first time since 2019 that the global semiconductor market will decline in four years.

This also marks the extremely hot semiconductor market during the epidemic, began to enter a state of adjustment. According to WSTS, the global semiconductor market surged 26.2 percent in 2021, but growth has slowed significantly to 4.4 percent this year, although growth in categories such as analog chips, sensors and logic chips remains in the double digits. On the other hand, WSTS expects the memory chip market to shrink by 12.6 percent.

Memory chips will also be a drag on the semiconductor industry in 2023. WSTS expects a 17 per cent year-on-year decline in the memory chip market, which accounts for a fifth of the industry. Others such as optoelectronics, sensors and analog chips will continue to see single-digit percentage increases.

Because semiconductors are so widely used in so many industries, demand from the semiconductor industry can also be a leading indicator of the overall economy. WSTS also said that the semiconductor market contraction in 2023 will mainly be in the Asia-Pacific region (-7.5%), while the market size of other regions such as Japan, the United States and Europe will be roughly flat or grow slightly.

The forecast is also in line with the direction of the industry in recent months. Semiconductor giants are still expanding, but the consumer market is flagging, with demand for smartphones and personal computers on the decline. On the enterprise side, big customers like Microsoft and Amazon have also started to cut back on data center investments, adding to the downward headwinds.

Global server chip shipments are expected to decline 2.8 percent in 2023, according to an earlier forecast by market research firm TrendForce Cimbon. By comparison, growth is expected to be 5.1 percent this year, and server operators are among the industry's biggest customers for memory chips